south carolina inheritance tax rate

Inheritance taxes on the other hand are imposed on the beneficiaries of the deceased after they have received an inheritance. Federal Estate Tax.

The Estate Tax And Real Estate Eye On Housing

Looking at the tax rate and tax brackets shown in the tables above for South Carolina we can see that South Carolina collects.

. South Carolina has no estate tax for decedents dying on or after January 1 2005. As used in this chapter. The federal estate tax exemption is 117 million in 2021.

If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40. Like estate taxes and inheritance taxes South Carolina also does not have a gift tax. 2021 SC Withholding Tax Formula 2021 SC W-4.

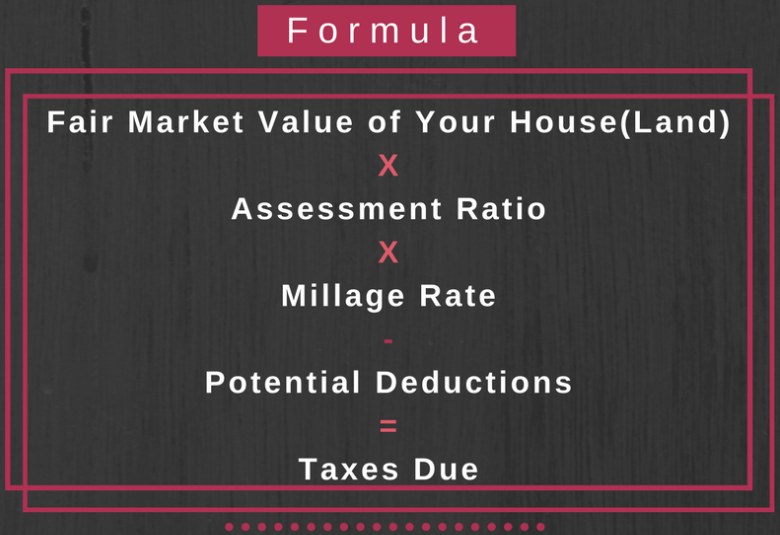

South Carolina Property Tax Breaks for Retirees For homeowners 65 and older. In South Carolina the median property tax rate is 566 per 100000 of assessed home value. See where your state shows up on the board.

The requirements for a valid will change from state to state but are pretty. South Carolina residents are still subject to it. If an inherited estate is valued above that amount then the excess money is taxed.

However if the estate is passing. Your average tax rate is 1198 and your marginal tax rate is 22. Like estate taxes and inheritance taxes.

If you make 70000 a year living in the region of South Carolina USA you will be taxed 12409. This marginal tax rate. The average family pays 118300 in South Carolina income taxes.

As of 2019 if a person who dies leaves behind an. On the one hand it makes the states estate planning and inheritance procedure easier. Some states have inheritance tax some have estate tax some have both some have none at all.

Even though there is no South Carolina estate tax the federal estate tax might still apply to you. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Tell me about the federal estate tax Often called the death tax the federal estate tax has been around for a long time. If a South Carolina resident is earning wages in a. South Carolina Income Tax Table Learn how marginal tax brackets work 2.

Creating a will is oftentimes the first step that South Carolina residents must take in estate planning. This threshold changes often but in 2020 the threshold was 1158 million. South Carolina and the federal government update Withholding Tax Tables every year.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. For decedents dying in 2013 the figure was 5250000 and.

South Carolina Tax Brackets 2022 - 2023. South Carolina Income Tax Calculator How. This chapter may be cited as the South Carolina Estate Tax Act.

In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation.

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

South Carolina Retirement Tax Friendliness Smartasset Com Income Tax Brackets Retirement Retirement Income

Where S My Refund South Carolina H R Block

A Guide To South Carolina Inheritance Laws

South Carolina Sales Tax On Cars Everything You Need To Know

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Moving To South Carolina Here S Everything You Need To Know

South Carolina Lawmakers Reach Deal To Cut Income Tax

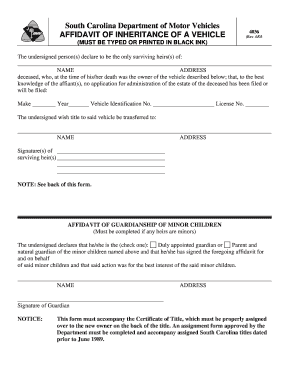

Inheritance Format Fill Online Printable Fillable Blank Pdffiller

Your Columbia Sc Real Estate Questions Answered

How Do State And Local Property Taxes Work Tax Policy Center

/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

State Tax Levels In The United States Wikipedia

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

South Carolina Estate Tax Everything You Need To Know Smartasset

Sc Real Property Tax Ultimate Guide For Charleston Berkeley And Dorchester Counties Rates Calculator Due Date And More Matt O Neill Real Estate